Market Update: 2024 Q1 in Review

After an impressive 2023, U.S. equities continued their upward momentum in the early months of 2024 with the Russell 3000 up 10% in the 1st quarter. The best performing segment continued to be large growth (think tech stocks) which were up 11.4% (Russell 1000 Index) and the worst performing U.S. equities were small value stocks (+2.9%). International stocks were also up by 5.9% during the quarter (MSCI EAFE), and emerging markets by a positive 2.4% (MSCI Emerging Markets Index). Why is it important to know how these various segments of the stock market performed?

This is why: Many retirement investors think of diversification of their portfolio as the mix between stocks and bonds. However, it is equally important to have the right mix of equities: large vs small, growth vs value, domestic vs international. The variance in returns we just discussed highlights the need for diversification in the equity portion of your portfolio. No one can predict what the next best performing segment will be, or else we would all have our money invested there!

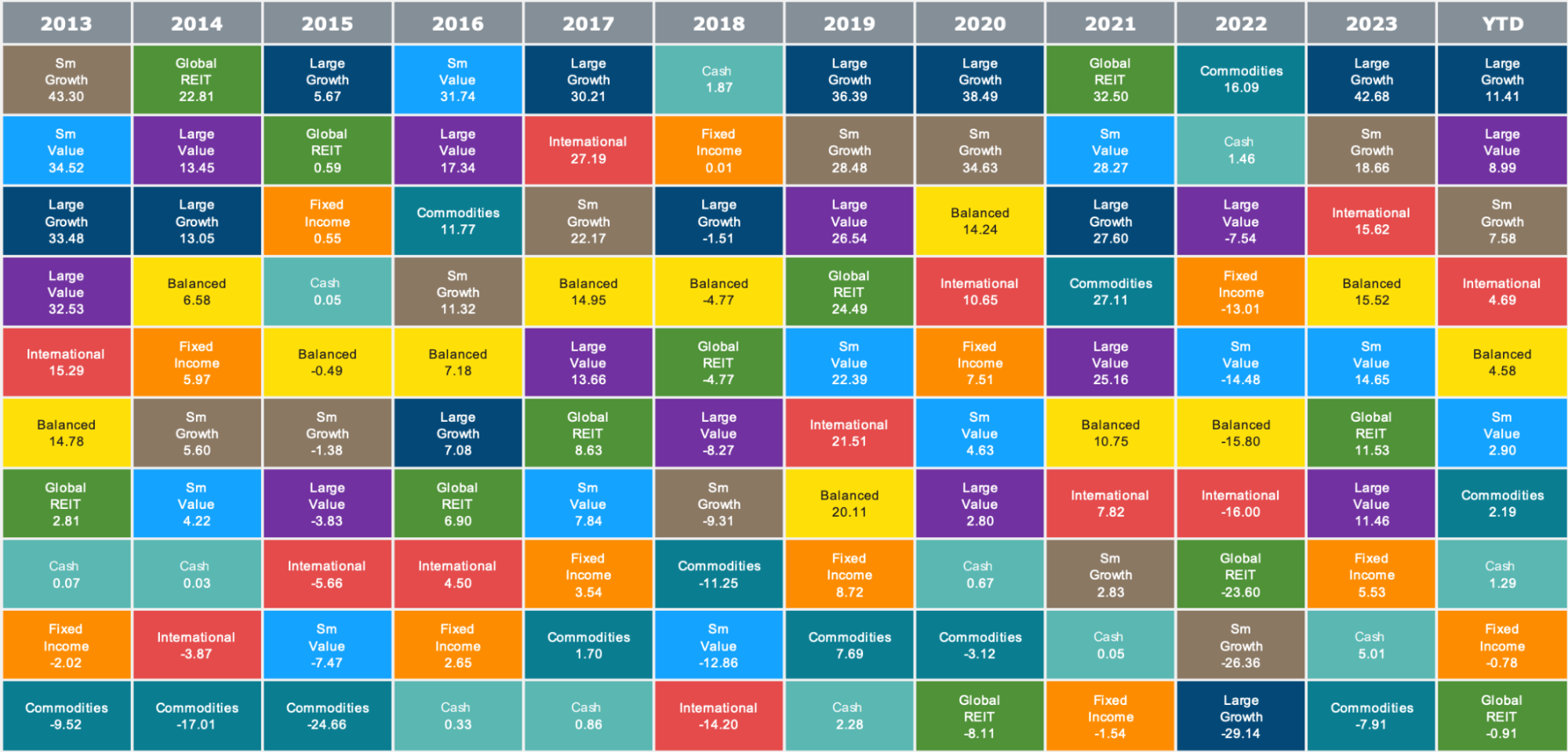

We call one of my favorite visuals to demonstrate this the “kaleidoscope”. And who did not enjoy a kaleidoscope as a kid? This chart below shows the best performing asset class over 11 time periods. While U.S. large growth has outperformed in over half of these time periods, take a look at 2022 when this category was down almost 30% and the best performing equity segment was large value.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Market segment (index representation) as follows: US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net dividends]), Emerging Markets (MSCI Emerging Markets Index [net dividends]), Global Real Estate (S&P Global REIT Index [net dividends]), US Bond Market (Bloomberg US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Global Aggregate ex-USD Bond Index [hedged to USD]). S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2024, all rights reserved. Bloomberg data provided by Bloomberg.

Per Dr. David Kelly, Chief Global Strategist at JP Morgan Asset Management, if economic growth continues at a steady pace in 2024, gains should broaden out beyond the largest stocks. In this environment, as always, a well-diversified approach is prudent in lowering volatility and gaining access to other asset classes that may provide other opportunities for returns. While many U.S. based investors feel inclined to focus on opportunities at home, a well-diversified portfolio should provide exposure to international markets as well.

If you have 20+ years to retirement age and are invested in a target date fund, your portfolio is likely mostly equities. If you are nearing retirement (within 10 years) you should probably be taking a closer look and evaluating whether your equity allocation is right for you based on your time horizon and personal risk tolerance.

Bonds have not performed well over the last few years thanks to all of the Fed actions to rein in inflation and uncertainty on when rate hikes would start to go the other way. The broad U.S. fixed income market returned a negative 0.8% (Bloomberg Barclays U.S. Aggregate) for the quarter with the best performing sector for the quarter High Yield Corporate Bonds, returning a positive 1.5%. Bonds can still be an effective tool for controlling volatility, however, as can cash.

Thanks to the Federal Reserve’s rate hiking campaign, cash looks more attractive today than in the last two decades. With yields north of 5% and minimal risk, many investors have decided to allocate more heavily to cash, pushing money market fund assets to a record high. While investors with a long-term horizon are generally better off investing in long-term assets like stocks and bonds, cash can be an important part of your portfolio particularly as you near the spending phase of retirement savings.

In summary, it is more important than ever that investors maintain well-diversified portfolios designed to reduce risk as well as provide solid long-term income and capital gains. If you are not sure if you are properly allocated, please schedule a time to chat with our team.