Market Update: 2023 in Review

Uncertainty about the economy and volatility in the financial markets has left some of us feeling like we are living in a constant state of financial fight or flight mode as it relates to our future financial security.

After double digit losses in 2022, and fears of recession carrying into 2023, the economy proved resilient last year and markets did as well with stocks soaring and bonds rebounding. The green arrows on the chart below reflect positive 2023 year end market returns for stocks and bonds looking back one, three, and five years.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Market segment (index representation) as follows: US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI World ex USA Index [net dividends]), Emerging Markets (MSCI Emerging Markets Index [net dividends]), Global Real Estate (S&P Global REIT Index [net dividends]), US Bond Market (Bloomberg US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Global Aggregate ex-USD Bond Index [hedged to USD]). S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2024, all rights reserved. Bloomberg data provided by Bloomberg.

Returns in the US markets (+25.96%) were driven largely by the “Magnificent 7”. You may recall references to the “FAANG” stocks that have dominated US markets over the last decade (Facebook, Amazon, Apple, Netflix, and Google (now called Alphabet). They’ve been replaced by the Magnificent 7 as the biggest drivers of US stock market performance, dropping Netflix and adding Microsoft, Tesla, and Nvidia.

While most of us in 401k plans have benefitted from the overperformance of these stocks, past performance is not a guarantee of future performance and underperformance of a concentrated group of stocks can also have an outsized impact on your retirement savings. It’s important in times like this to make sure your portfolio is well positioned to capture returns from other asset classes, and not overly allocated to the US tech sector.

Going forward, we can expect to continue to see mixed opinions on the economy, specifically whether we are headed into a recession or soft-landing (which just means a smoother transition from growth to a flat economy without recession). Where we end up depends on a complicated variety of factors including corporate profits, consumer resiliency, and geopolitical risks.

The good news for all of us is that unemployment is still low and inflation has finally cooled (currently 3.7% down from a high of over 9%) and, while we may be stuck with higher prices on many things, the Fed is likely at the end of its rate hiking cycle slowing down future inflation.

Outside of the US, the global economy also proved to be more resilient than expected, despite dramatic headlines. The Eurozone, UK, Canada, and China struggled while Japan and emerging markets outside of China (India for example) were stronger, making the case for having exposure to emerging markets in a well-diversified portfolio.

Bonds, meanwhile, were volatile in 2023 due to a number of factors including interest rate hikes. However, current yields on bonds still offer much better income and return opportunities than were available to us a year ago. US bonds returned an average of 5.53% in 2023 and non-US bonds 8.32%, and bonds remain an important asset class for diversifying your portfolio.

With a mixed outlook for the economy and markets, we are reminded that market timing is futile and that time IN the market is more important than trying to time the market.

Action Items from Our Team

What does this mean for your retirement planning? Since it’s the New Year, it’s a great time to go back to the basics and reevaluate your personal plan with three simple tasks.

1. Decide how much longer you plan to work and how you want to live in retirement.

If you are under age 40, retirement probably seems like a lifetime away and you may have no idea. That’s fine. Just move on to step 2 (you still need to be saving!). However, if you are 50+, you need to give this some thought. You may be a Gen X workaholic who thinks you will work forever, but there are many factors you cannot predict, such as future employment and/or your health. So, do yourself a favor, request your Social Security statements at http://ssa.gov and start getting clear on how much longer you want and need to work.

2. Review your saving rate and make adjustments as needed.

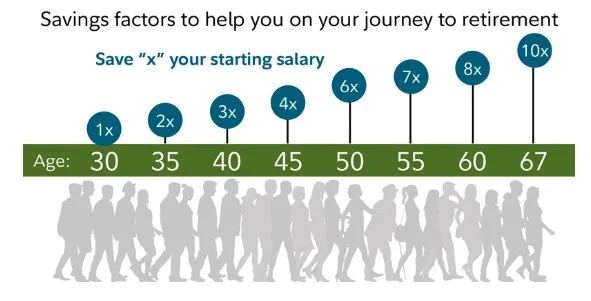

Ultimately, most of us should be saving 10-15% of our income towards retirement. If you cannot save 10%, start where you can and schedule an annual increase if your plan doesn’t already do that for you. Note: If you receive a company match, make sure you are saving at least enough to receive the full match. Although admittedly oversimplified, I like Fidelity’s chart below as a quick guide on how much you should have accumulated over time, as a multiple of annual salary. For example, if you make $50,000/year, aim for having 3 times that ($150,000) saved by the time you are age 40.

Source: Fidelity

3. Review your asset allocation and make adjustments as needed.

If you are using an age-based target date fund, there’s a good likelihood you’re within a range of where you should be. That said, double check the vintage of your fund. If you are in a 2040 fund, that means you should be around your retirement age in the year 2040. Most target date funds use a target retirement age of 65 so if you plan to retire early or late, you may need to make an adjustment. If you are in a risk-based model or have selected your own allocation, reach out to your plan advisors or 401k provider for a second opinion.

In general, the longer you have until retirement, the higher allocation you will want to equities. The great thing about target date funds, and why we often use them as the default option, is that they automatically derisk for you as you get closer to retirement by shifting some of the equity exposure to bonds.

Lastly, once you have a plan, stick with it. Unfortunately, life can throw us curve balls and sometimes we can get off track due to job or family changes. If you have fallen off, or fall off in the future, just get back on the horse as soon as you can and don’t lose faith in yourself. You can do it! 💪

As always, reach out to your retirement plan advisors if we can help. We wish you a happy and financially secure year.